How To Find Out If Your Credit Has Been Compromised

As data breaches become increasingly common, many people are falling victim to credit card leaks. Unfortunately, most don't find out that they were part of a breach until notified by their financial institutions.

But how are credit cards leaked in the get-go place? Are there ways to proactively find out if you are office of a credit menu breach to minimize harm and protect your sensitive data?

How Are Credit Cards Leaked?

A security incident such every bit a data alienation affecting a bank or any other database where your credit card or personal data is stored can betrayal your credit card information to the world. Once that happens, y'all tin can become role of a data leak. Such information is often sold on the nighttime web.

Here are some common methods through which credit cards tin can exist leaked.

Phishing Emails

The sole purpose of phishing emails is to dupe users into clicking fraudulent links or downloading malicious attachments. The links seem apparent and familiar but may enquire users to click on further dubious links or inquire them to enter account information.

Public Wi-Fi Networks

While information technology's nice to be able to admission public Wi-Fi when you are grabbing coffee or waiting at an airdrome, there's always some risk involved.

Public networks are susceptible to data breaches and Wi-Fi frag attacks. If you lot punch in your sensitive details or access your bank website while using public Wi-Fi, you can easily fall victim to such attacks.

Tip: Install a VPN on your device if you often utilize the cyberspace in public.

Skimming

While skimming by and large affects older card types with magnetic strips, this method can nevertheless cause a lot of issues.

Skimming commonly happens when a thief steals your credit card number while y'all are making a transaction and then uses it to create a counterfeit menu or deport out online transactions that don't require a physical carte du jour. Sometimes, device skimmers are also used in places such as unattended terminals to steal card data.

Tip: Transition to EMV fleck cards if you haven't already equally they prevent device skimmers from interpreting data. It's worth paying special attending to unattended payment booths and terminals. If y'all see something unusual in the bill of fare slot, refrain from using it and alert an employee if possible.

Major Data Breaches

Large organizations similar retail businesses and banks may autumn victim to information breaches which can put yous at risk of credit card leaks also.

One of the biggest data breaches of modern times hit Capital One in 2019 and affected tens of millions of consumers.

Insider Attacks

Insider attacks happen when a privileged user like an admin or even a disgruntled employee with access to a cardholder database decides to exfiltrate the information. While various measures (such as logging) exist in the cyberbanking system to prevent that from happening, the reality is that anyone with admission tin can tamper with user logs if they wanted to.

Credit card leaks attributable to insider attacks are minimal but there is always a possibility that they tin can happen.

Cardholder Information in Logs

Log files are much less protected than a cardholder database. Occasionally, a developer could make a mistake that could get by review and button thousands of credit bill of fare numbers into log files instead.

Once that happens, it can be very like shooting fish in a barrel for attackers who are on the lookout, to find credit bill of fare numbers in the logs files.

Formjacking

Formjacking is a way of collecting credit card information before it enters a secure surroundings. This type of set on uses script injection (via compromised static resource) to collect the data as the user is typing it.

Have Your Credit Card Details Been Leaked?

Worried nigh your credit card information being leaked? Here are some tell-tale signs to await out for.

Strange Purchases on Your Business relationship

Seeing unknown purchases on your bank account argument is a big red flag indicating that your credit carte du jour might have been breached.

Credit menu leaks tin happen at whatever time, and then it's important to keep checking your banking concern account regularly to stay on top of things.

Small-scale Charges on Your Business relationship

Most credit card thieves start off by making pocket-sized purchases on your credit card to avoid triggering any red flags. A trickle of modest charges that wait unfamiliar is a potential sign that someone has been using your credit carte du jour for purchases.

Unfamiliar Company Names on Your Statement

If an unfamiliar name appears on your statement for the payments you take made, then you lot should contact your credit card company to dispute the charges as soon as possible.

Noticing a payment made to a company proper name that y'all're non familiar with could signify a credit card leak.

A Lower Bachelor Credit Balance

Unexplained pending charges that show a macerated credit line hint that your credit card has been leaked or tampered with.

If there are no justifiable big item purchases on your end then you should ever investigate the real reason behind the change in your available credit.

How to Protect Yourself Against Credit Card Leaks

It'southward always best to be proactive and mitigate any risks associated with your credit cards. The following strategies can help.

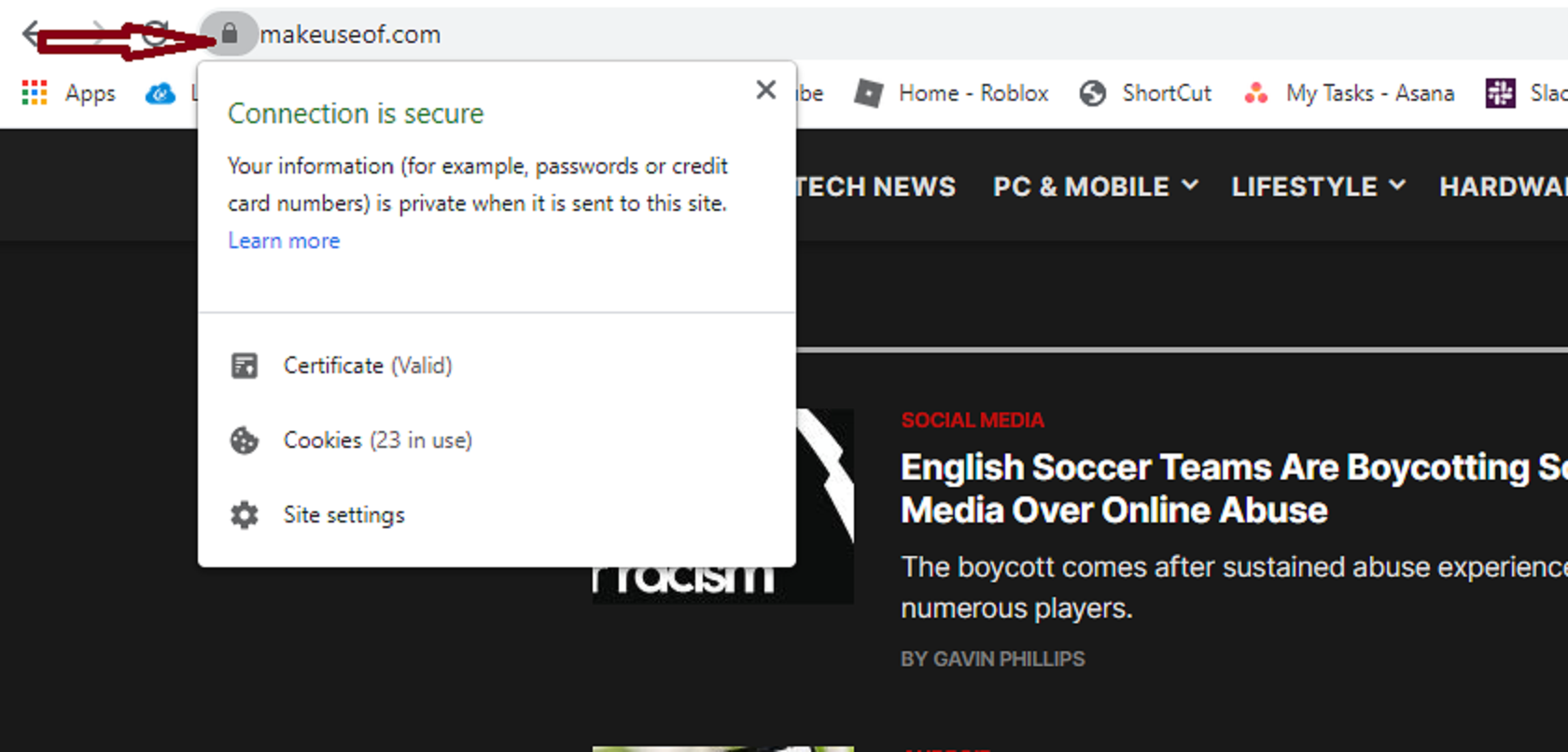

Employ Secure Websites Only

It is crucial that you lot avoid entering personal data on unsecured websites. Wait for a tiny padlock icon earlier the website address in the URL to ensure the site that you are trying to reach is encrypted using the secure HTTPS version of the cyberspace.

While not a guarantee, information technology does provide some assurance that the website is practicing a higher level of security.

Don't Give Your Account Number Over the Phone

Never give out your credit card or account number on the phone unless yous are certain of the caller'south legitimacy. Be actress cautious of any random scam calls where a caller asks you for your credit carte information.

Just put: don't share individual details over the phone!

Check Credit Bill of fare Statements Regularly

Checking your statements regularly is the all-time manner to protect against credit card leaks and fraud. Equally a rule of thumb, you should check your statements at least once a calendar month.

Inform your card issuer or financial institution immediately if you lot notice whatsoever suspicious charges.

Continue an Eye on Your Card During In-Person Transactions

Never allow whatever employee at a restaurant or a retail store take your credit card and walk away with it. Once out of sight, the person property your menu can write downwardly your carte du jour number, expiration engagement, and security code—or make contactless payments!

Be Proactive and Limit the Harm

Much of preventing a data breach entails limiting the damage later on your credit carte details have been compromised.

Time is of the essence once you realize that your credit card might exist tampered with. So act fast and freeze your breached credit card.

At the aforementioned time, keep monitoring your financial statements, and sign upward for identity theft and monitoring services.

Just remember that, by applying mitigation strategies earlier damage strikes, you will not only limit the damage to your credit cards but tin besides prevent futurity attacks.

Source: https://www.makeuseof.com/leaked-credit-card/

Posted by: kirbycathe1975.blogspot.com

0 Response to "How To Find Out If Your Credit Has Been Compromised"

Post a Comment